What defines the best debt collector for your business? Choosing the right agency will maximize the amount of debt that you collect. You need a transparent agency that will help you to maintain a positive image in the market.

You also need to have a good relationship with your customers even if they have failed to pay for your goods or services. The tips below will help you to choose the right debt collection agency for your business.

Consider the Total ROI and Not Just the Initial Price

When deciding on the debt recovery partner to choose, the collection percentage that they charge is just one of the factors to consider. Most people compare debt collectors based solely on this percentage, but the most important thing should be the cash that they finally put back in your wallet.

Most companies will charge you a straight percentage of what they collect, but the results they attain in various accounts vary significantly. If the percentage is low, it will make the company work on easy to collect debts and ignore the others.

It is better to go for an agency that charges higher percentages and has better recovery rates. Such an agency will even have a private detective to aid the collection process. Compare the type of results that the various agencies have been able to establish in the industry. The knowledge will help you to decide based on real returns and not the perceived expenditure.

Insist on Customer Service

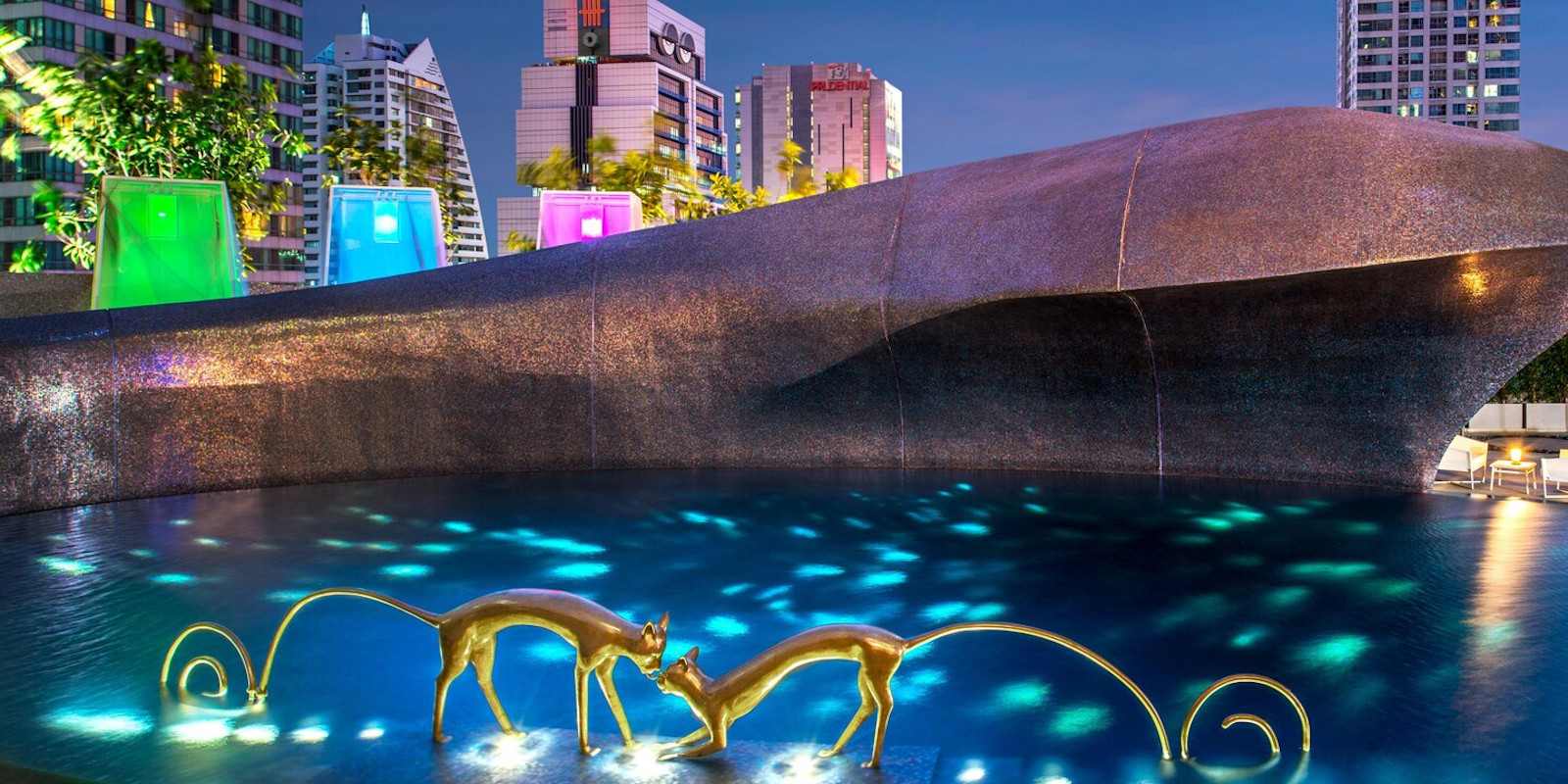

Gone are the days when debt collectors would harass the defaulted clients. Modern debt collection agencies will want to make it easy for the customer to clear his debt through early intervention, proper payment plans, and multiple channels. Get an agency that will help you to supplement your in-house processes by issuing payment notices early enough in the debt cycle.

As you outsource debt recovery, be keen on the sensitive nature of the relationship that exists between your brand and its customers. There should be a balance between customer satisfaction and a high ROI. Make sure you are partnering with a reputable agency in Malaysia.

· Look for Partners and Not Collectors

The best collection agency partner will help you to develop a good system for managing your financial accounts receivables and hence increase the bottom line. These agents are specialists in collecting money, and they need to work with your team to improve the in-house collection efforts.

A good collector will hire a private investigator to help with the hard cases. Some of them will conduct credit checks on your potential customers and also help you in instituting collection measures that will send payment reminders at certain intervals.

· Look at Their Track Record

The best decision will come from those people who have used these services before. Get referrals from the individuals or organizations that know the company best. Some of the best sources include better business bureaus, chamber of commerce, business contacts, and accounting firms.

The laws of collection vary from one industry to another, and it is good to choose a debt collector who has experience in a particular field. Such people are in a better position to deal with the unique challenges of the industry and use it to improve the process of debt recovery while maintaining compliance.

· Check for the Required Licensing

The collection laws expect all agencies to be licensed for them to practice in a given state. Therefore, make sure that you are dealing with a business that has a local license. The debt collector should be licensed to run business in your area of residence.

· Evaluate Reporting

The worst thing a collection agency can do is not reporting the collection rates regularly. You should be supplied with at least a payment on any account or monthly statement. A good agency will have an online portal where you can access all this information at any time. The right company will help you to understand your cash flows. Make sure you do some due diligence before making the final decision if you want to get the best results.